Credits

Icon from Streamline Icons

Icon from Streamline Icons

Nature‘s Care通过自身25年的发展,致力打…

澳洲环球财富投资公司(股票代码GFI上市…

澳大利亚外交部部长Hon Julie Bishop女士…

2018年5月9日,澳大利亚国家证券交易所(N…

3月14日,澳大利亚前联邦总理Tony Abbo…

2018年3月7日,GFI(环球财富投资有…

澳洲总理谭保(Malcolm Turnbull)在…

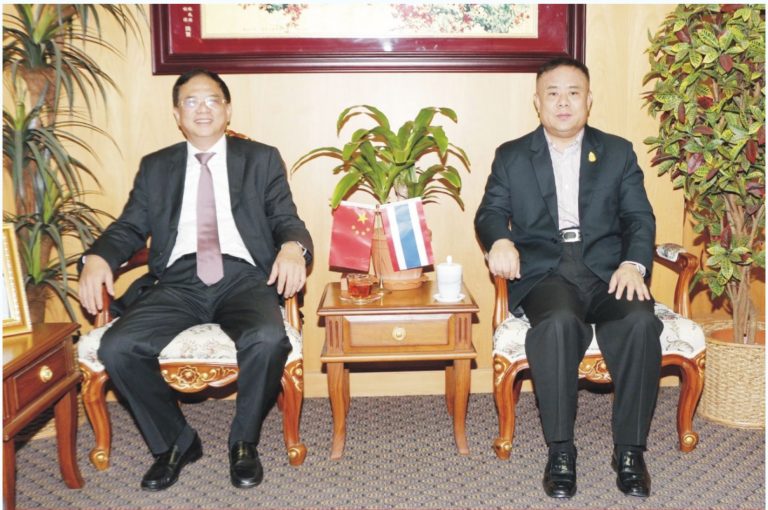

11月23日下午,中国湖北省侨联副主席、…

澳大利亚–是世界这一充满生机的国度…